PCB manufacturers in Japan and Korea have shifted their production focus from traditional multi-layer rigid boards, high-end HDI, flexible PCB and rigid flexible bonded boards to IC substrates.

Among them, Japanese IC substrate suppliers Yifei Electric Co., Ltd. and Shinkitsu Electric Industry Co., Ltd. will continue to invest heavily in expanding ABF substrate production capacity, which is expected to account for more than 30% of the total output value of PCB in Japan this year.

Both companies saw revenue jump last year on strong demand for ABF packaging substrates used in high-performance computing chips and CMOS image sensor chips.

And South Korea's major PCB manufacturers LG Innotek, Semco and Daeduck Electronics have stopped producing HDI or rigid composite boards in recent years, focusing more on the production of mobile phone SoC and 5G transmission chips used in the size of the BT packaging substrate, such as crystal chip. As well as AiP substrate and RF module substrate.

Korea s IC substrates are also expected to grow rapidly, accounting for more than 30 percent of the output of PCBS.

IC substrate market demand is strong

IC packaging substrate, also known as IC carrier board, is directly used to carry the chip, not only to provide support, protection, heat dissipation for the chip, but also to provide electronic connection between the chip and the PCB mother board.

The global IC packaging substrate market is growing steadily and is expected to exceed $10 billion by 2022. By 2025, the total capacity of IC packaging substrate in the Chinese market will increase to 1.94 million square meters, with a compound annual growth rate of 5.9%.

As the demand for downstream consumer electronics, 5G base stations, servers and automobiles increases, high-speed network communication chips are shipped in large quantity, which makes the demand for ABF packaging substrate strong.

Experts in the semiconductor closed test field said that large-scale FC-BGA substrates were in a capacity shortage last year due to the increased demand for LSI chips such as cpus and Gpus due to the outbreak of COVID-19. The root cause of the shortage of FC-BGA substrates is the shortage of ABF, the core material.

Prior to this, the industry has been repeatedly rumored ABF supply is low. Since the fall of 2020, TSMC has been running low on ABFs. In addition, industry chain sources revealed that the delivery cycle of ABF has been as long as 30 weeks.

It is expected to reshape the industrial structure

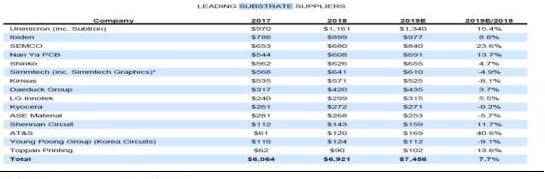

At present, the global packaging substrate market is basically occupied by PCB companies from Taiwan, Japan and South Korea, such as UMTC, Ibiden, SEMCO, Nasia Circuit Board, Kinsus, etc. The top ten companies have a market share of more than 80%, showing a high industry concentration.

The world's top 15 packaging substrate (IC carrier board) manufacturers

However, as the PCB industry in the United States, Japan, South Korea and Taiwan has entered a mature or even declining period, its output value also gradually showed a downward trend. Japan, which represents the global high-end PCB manufacturing level and leads the development direction of global PCB, has weakened its competitiveness in recent years due to its market strategy and price level.

Chinese local PCB enterprises are expected to share the dividend of industrial transfer and industry concentration improvement, and are gradually taking over PCB production capacity of other countries and regions. With the significant improvement of capacity utilization of the two major domestic OEM factories of SMIC and Huahong Semiconductor, it will drive the development of their downstream closed test manufacturers.

In the field of conventional packaging substrate, Shennan Circuit, Xing Sen Express, Zhuhai Yue Ya and other domestic manufacturers have mass production, technology is relatively mature, and has announced the expansion of production. With the gradual expansion of the scale of domestic substrate manufacturers, the subsequent cost advantage will be obvious.

In addition, domestic manufacturers speed up the layout of HDI products and catch up with Taiwan manufacturers. The production capacity is concentrated in the second half of 2021. The HDI mainly launched for the first, second, third and high-end production capacity above Anylayer is still in short supply.

In terms of automotive PCB, Kaiyuan Securities estimates that the global automotive PCB market will reach 505.5/5918/67.39 billion yuan in 2020-2022, and domestic manufacturers will accelerate the matching of automotive PCB products.

Shenzhen HongYuan Electronics Co.,Ltd

Shenzhen HongYuan Electronics Co.,Ltd